Introductory Remarks

The consolidated income statement, statement of financial position and statement of cash flows of the Salini Impregilo Group as at June 30, 2014, are presented in continuity with those of the Salini Group for the year ended December 31, 2013, taking into consideration the fact that the acquisition of control by the former controlling company (now acquired company) Salini S.p.A. over the former subsidiary (the acquirer) Impregilo S.p.A. occurred after the end of the first quarter of 2013 and the fact that the merger of Salini and Impregilo was completed after the acquisition of control by the former over the latter and thus qualified as a business combination of entities under common control in accordance with the IAS/IFRS standards. This Half-year consolidated financial report presents, for comparative purposes, (i) the consolidated income statement of the Salini Group for the first half of 2013 and (ii) the consolidated statement of financial position of the Salini Impregilo Group at December 31, 2013. That being said, and in view of the significant contribution that the assets held by the former Impregilo provided in the period reviewed in this Half-year consolidated financial report, as well as the fact that these assets were recognized in the Salini consolidated financial statements for the same period last year only as from April 1, 2013 – date used as a reference for the acquisition of control by Salini – for the sake of facilitating comprehension and comparability of the results for the first half of 2014 with those for the first half of 2013, it was deemed appropriate to restate the comparative economic results on a homogeneous basis to that of June 30, 2014. This presentation, provided exclusively for information purposes, is shown and commented later in this Half-year financial report, in the section entitled "Performance of Salini Impregilo Group operations in the first half of 2014".

Moreover, on June 20, 2014, as part of an operation aimed at Italian and international institutional investors, the Board of Directors of the parent company Salini Impregilo S.p.A. exercised the powers granted to it by the Extraordinary Shareholders' Meeting held on September 12, 2013, and approved the share capital increase limited to 10% of the existing capital, waiving option rights. The operation was successfully completed with the issuance of 44,740,000 new ordinary shares without par value and the increase in share capital amounting to €44,740,000. The subscription price of the shares was set at €3.70 per share, while the consideration received, net of directly related additional expenses, was €161.5 million. In the same context and at the same time of this offer, aimed, as described, to Italian and international investors only, the parent company Salini Costruttori S.p.A. sold 94,000,000 Salini Impregilo S.p.A. ordinary shares. Finally, taking into account that the so-called "greenshoe" option was exercised on July 18, 2014, by the Joint Global Coordinator of the operation, for an additional number of 4,050,000 ordinary shares, to date the free float of Salini Impregilo S.p.A. is roughly 38.11% of the ordinary share capital.

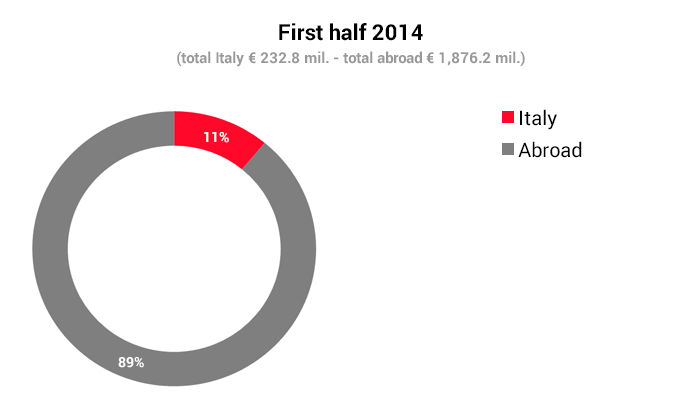

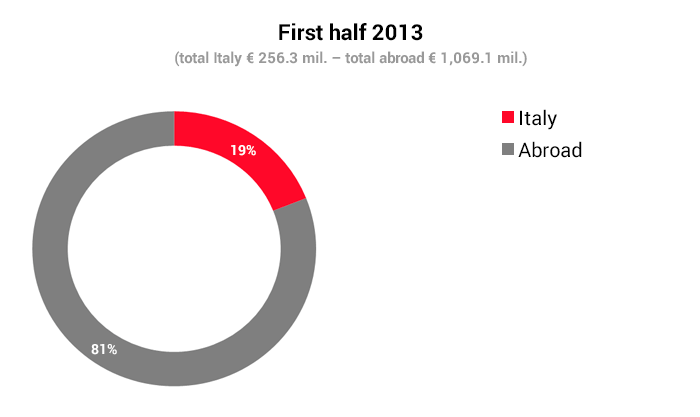

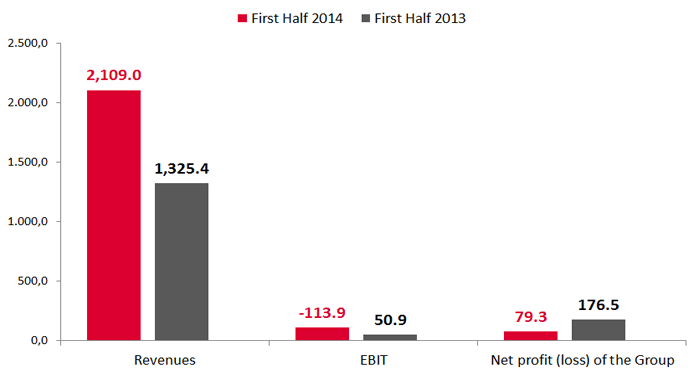

The Salini Impregilo Group closed the first half of 2014 with a total revenue of €2,109.0 million (€1,325.4 million in the first half of 2013), operating profit (EBIT) of €113.9 million (€50.9 million in the first half of 2013) and a net profit attributable to the owners of the parent of €79.3 million (€176.5 million in the first half of 2013).

Owing in part to the steady implementation of the plan to monetize and divest non-core activities, the relevant competitive scenario of the Salini Impregilo Group is currently represented by the global market for activities and investments in the construction sector, with specific focus on the market for complex large-scale infrastructures.

At the international level, macroeconomic conditions show an improvement compared with the data for the previous year. According to recent estimates published by the OECD, the GDP of the 34 most developed economies should grow by 2.2% in 2014 and 2.8% in 2015. The global economy, however, should expand at a faster rate, growing by 3.4% in 2014 and 3.9% in 2015.

In this environment, the Salini Impregilo Group, while pursuing the strategic objective forming the basis of its industrial programs, as outlined in the 2014-2017 Industrial Plan approved on March 19, 2014, has successfully pursued, in the first part of this year, new and important opportunities in its target markets, including, for example, the new orders for projects involving the Lima subway system, in Peru, and the construction of the Brenner base tunnels, in Austria.

Furthermore, consistent with the implementation of the plan to monetize Group's non-core assets, the sale to third parties was finalized in the first half of 2014 of the entire interest - equal to 100% - held by the Group through its subsidiary Impregilo International Infrastructures N.V., in the German company Fisia Babcock Environment GmbH. Taking into account the fact that this interest, at March 31, 2014, was classified in accordance with IFRS 5 under "Non-current assets held for sale and discontinued operations", the net profit of the aforementioned sale, amounting to roughly €89.2 million, was accordingly reflected in the net profits of the assets held for sale.

Lastly, starting from the end of the period reviewed in this Half-year financial report, the estimates referring to the set of industrial activities that the Group has in the Bolivarian Republic of Venezuela required updating. In line with the previous financial reports, made available to the public as required by the current legal provisions, the deterioration of the economic conditions of the country, which have been going downhill since the early months of the year, were such that it became necessary to make a detailed assessment of the time and financial parameters according to which the Group's net assets can be generated in reference to this area. The Group's relations with the local economic system as well as with the customer local administrations are still excellent and geared towards maximum cooperation in pursuit of the respective goals, as demonstrated by the additional work awarded at the end of June 2014 in relation to existing railway contracts. However, in light of the current general framework of the local currency/financial market situation in the area, stemming from the conditions of the above-mentioned local economic system, and consistent with recent changes to the currency regulations of the country, it was considered reasonable, among other things, to adopt, with effect from June 30, 2014, a new reference exchange rate for the translation of both the current values of working capital denominated in Venezuelan currency and the perspective values both to be paid/realized in the entire life estimates of the ongoing railway projects under direct management.

The new official exchange rate used, called SICAD 2 and whose first fixing took place during the last few days of the first quarter, is currently believed to be the most representative of the relationship under which future cash flows, expressed in local currency, may be adjusted in the event that they were verified at the valuation date also considering the possibility to access the Venezuelan currency market and the Group's specific needs to obtain currency other than the functional currency.

This new exchange rate expresses a substantial depreciation (by about 9 times) of the local currency against the US Dollar, compared with the official exchange rate previously used, i.e. CENCOEX (formerly CADIVI), for the purposes of preparing both the consolidated financial statements of the Salini Group as at December 31, 2013, and the Directors’ Report as at March 31, 2014.

The update of the estimates described below, for which further details are provided in the subsequent sections of this Half-year consolidated financial report, resulted in some effects as at June 30, 2014. Among the most significant effects were (i) the overall impairment of net financial assets denominated in local currency, for a total of approximately €55 million and (ii) the reduction of the order backlog relating to the same projects, for the part denominated in local currency including the variants recently acquired and uniformly assessed, for a total of approximately €100 million.

Group total revenue for the first half of 2014 totaled €2,109.0 (€1,325.4 million in the first half of 2013 and €1,868.8 million on a homogeneous basis) .

The consolidated operating profit (EBIT) amounted to €113.9 million (€50.9 million in the first half of 2013 and €116.5 million on a homogeneous basis) with a return on sales (ROS) of 5.4%.

The consolidated financing income (costs) and gains (losses) on investments generated net financing costs of €81.8 million (net gain of €169.9 million for the first half of 2013 and net financing costs of €38.7 million on a homogeneous basis) during the period.

The profit from assets held for sale and discontinued operations, amounting to €55.3 million (loss of €20.3 million in the first half of 2013 and profit of €74.7 million on a homogeneous basis), reflects the results of the Todini Group (loss of €26.2 million), of Fisia Babcock Environment (profit of €85.1 million) and the USW Campania Projects (loss of €3.6 million). With regard to the latter, further details are provided below in the chapter entitled "Non- current Assets Held for Sale and Discontinued Operations” of this Half-year financial report.

The consolidated net profit attributable to the group for the period under review amounted to €79.3 million (€176.5 million for the first half of 2013 and €110.5 million on a homogeneous basis).

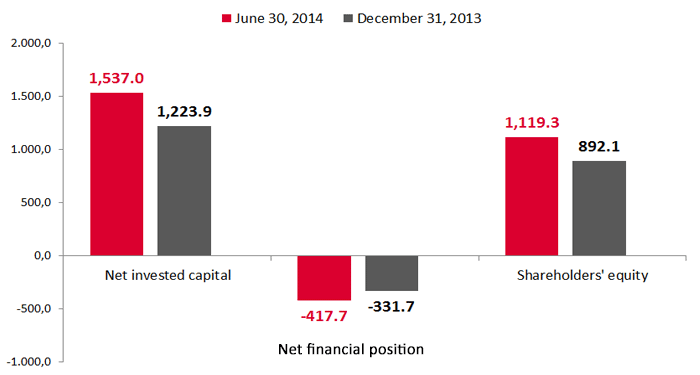

The consolidated net indebtedness of continuing operations totaled €417.7 million at June 30, 2014, compared with €331.7 million at December 31, 2013, while the gross financial debt decreased, in comparison with December 31, 2013, totaling €270.0 million.

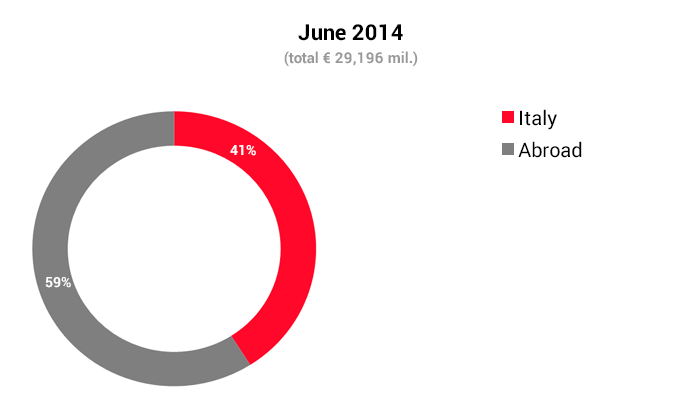

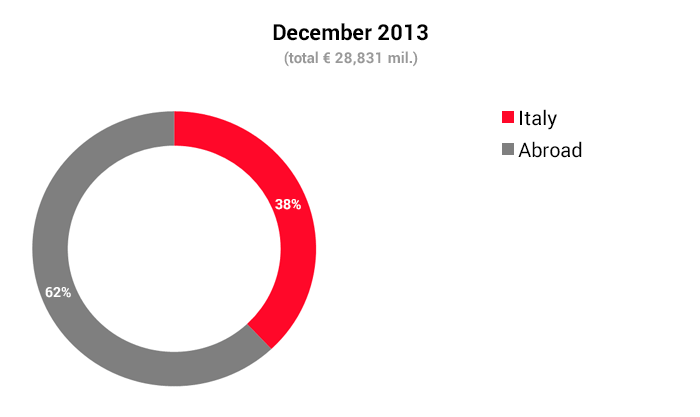

The Group's order backlog amounted to €29.2 billion for the period, including €7.2 billion in the portfolio of full-life concession projects.

New contracts for the first half of 2014 totaled €3,451.1 million.

1 The consolidated income statement data for the first half of 2013, restated on a homogeneous basis for comparison with the first half of 2014 are included in the next section of this Half-year financial report.

Financial highlights

The paragraph “Alternative performance indicators” in the “Other information” section gives a definition of the financial statements indicators used to present the group’s highlights.

The income statement data for the first half of 2013 were reclassified due to the adoption of the new standards IFRS 10 and IFRS 11 and in accordance with the provisions of IFRS 5 and IFRS 3, also including the line-by-line consolidation method of Impregilo only from the start of the second quarter. The statement of financial position data at December 31, 2013 were reclassified due to the adoption of the new standards IFRS 10 and IFRS 11.

CONSOLIDATED INCOME STATEMENT

| (Values in millions of euros) | First Half 2014 | First Half 2013(§) |

|---|---|---|

| Revenue | 2,109.0 | 1,325.4 |

| Operating costs | (1,916.3) | (1,220.5) |

| Gross operating profit (EBITDA) | 192.7 | 105.0 |

| EBITDA % | 9.1% | 7.9% |

| Operating profit (EBIT) | 113.9 | 50.9 |

| R.o.S. | 5.4% | 3.8% |

| Financing income (costs) | (86.8) | (34.0) |

| Gains (losses) on investments | 5.0 | 203.9 |

| Earnings before taxes (EBT) | 32.1 | 220.8 |

| Income taxes | (12.2) | (23.7) |

| Profit (Loss) from continuing operations | 19.9 | 197.1 |

| Profit (loss) from discontinued operations | 55.3 | (20.3) |

| Profit (loss) for the period attributable to the owners of the parent | 79.3 | 176.5 |

(§) The income statement data for the first half of 2013 were reclassified following the adoption of the new standards IFRS 10 and IFRS 11 and in accordance with the provisions of IFRS 5 and IFRS 3. Furthermore, Impregilo was consolidated using the line-by-line method only from the start of the second quarter.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

| (Values in millions of euros) | June 30, 2014 | December 31, 2013 (*) |

|---|---|---|

| Non-current assets | 749.0 | 746.9 |

| Non-current assets (liabilities) held for sale | 188.4 | 235.5 |

| Provisions for risks, post-employment benefits and employee benefits | (121.3) | (122.7) |

| Other non-current assets (liabilities) | 15.9 | 16.5 |

| Tax assets (liabilities) | 80.1 | 81.2 |

| Working capital | 625.0 | 266.5 |

| Net invested capital | 1,537.0 | 1,223.9 |

| Shareholders' equity | 1,119.3 | 892.1 |

| Net financial position | 417.7 | 331.7 |

(*) The statement of financial position data at December 31, 2013 were reclassified due to the adoption of the new standards IFRS 10 and IFRS 11.

ORDER BACKLOG BY GEOGRAPHIC REGION

REVENUE BY GEOGRAPHIC REGION