The Group operates in the Construction and Concessions sectors in Italy.

Macroeconomic scenario

In 2015, Italy’s growth outlook became increasingly positive and the country began to grow again.

The OECD ranked Italy as one of the Eurozone economies with the highest GNP growth rates for this year (+1.4%), thanks to improved labor market conditions and a resulting increase in domestic consumption.

The recovery continued gradually over the course of the year. Exports weakened and, after underpinning activity levels for the past four years, are now held back, just like in other Eurozone countries, as a result of a drop in demand from non-EU countries.

Exports were gradually replaced by domestic demand, and in particular by consumption and inventory buildup.

Thanks to more favorable cyclical conditions in the manufacturing sector, the service sector experienced an expansion and the construction sector stabilized after a long downturn. Forward looking indicators forecast this recovery to strengthen from the beginning of this year: the stimulus package for the purchase of capital goods enshrined in the 2016 Stability Law should support investments starting already from the first Quarter; moreover, capital growth should be positively impacted by investments in the building sector, which should benefit from increasing signs of recovery in the real estate market already observed starting from the second half of last year. The current and forward-looking sentiment of consumer households and companies about the overall trend for the economy remains positive.

The growth outlook is improving, with a relevant consolidation of the Italian economy’s recovery from the recession that started in summer 2011 and continued until autumn 2014, and that rapidly followed the shorter, but more intense 2008-2009 crisis. The speed of this recovery, however, is strongly linked to the international economic scenario.

Construction

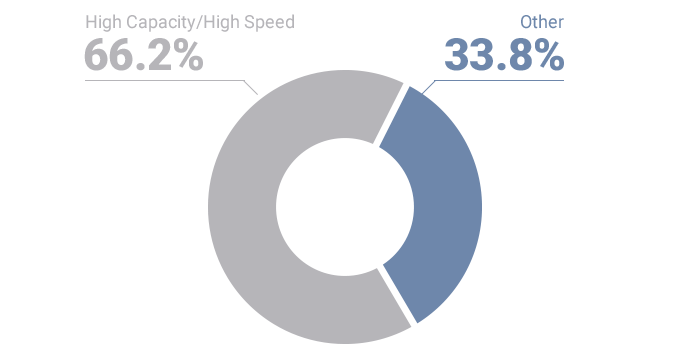

The order portfolio for the construction sector in Italy is shown below:

| Scope | 2015 residual portfolio | Percentage of total |

|---|---|---|

| High Speed/High Capacity | 6,019.9 | 66.2% |

| Other projects | 3,073.3 | 33.8% |

| Total | 9,093.2 | 100.0% |

The following chart shows the breakdown of the order portfolio by type of activity:

Summary of Construction Order Portfolio for Italy

|

Projects | Group residual portfolio | Percentage of completion |

|---|---|---|

| Cociv Lot 1-6 | 3,905.1 | 13.9% |

| Iricav 2 | 2,111.0 | - |

| CAVET | 3.8 | 99.9% |

| High Speed/High Capacity | 6,019.9 | |

| Broni - Mortara | 981.5 | - |

| Metro B | 946.3 | 0.1% |

| Milan Metro M4 | 407.3 | 17.6% |

| State Highway 106 Ionica | 337.0 | 2.5% |

| Port of Ancona | 223.5 | - |

| Isarco underpass | 117.8 | 4.6% |

| Stazione Tribunale | 20.7 | - |

| Highway, Lot 6 Salerno-Reggio di Calabria | 16.4 | 97.0% |

| Highway, Lot 5 Salerno-Reggio di Calabria | 16.1 | 98.7% |

| Spriana Landslide | 2.2 | 95.2% |

| State Highway 36 connector | 1.4 | 99.5% |

| Pedemontana Lombarda - Lot 1 | 1.4 | 99.7% |

| Metro B1 | 1.0 | 99.6% |

| Mestre Bypass Salerno-Reggio di Calabria | 0.4 | 99.9% |

| A4 building of third lane | 0.3 | 99.7% |

| Other projects in Italy | 3,073.3 | |

| Total | 9,093.2 |

Line 4 of the Milan Metro

Salini Impregilo, leader and lead contractor of a joint venture, won the tender called by the City of Milan for the selection of a private partner in a public/ private partnership, which will grant a concession for the engineering, construction and subsequent operation of Line 4 of the Milan Metro. The new line, which will be fully automated (there will be no driver on board), will encompass a total of 15.2 km along the Linate-Lorenteggio section.

The total value of the works - consisting primarily of civil works, provision of technological services, and mechanical works - is approximately €1.7 billion, with about two thirds of the contributions coming from public State and City grants.

In 2013, the Company M4 S.C.p.A. and the Client signed the Addendum to the Ancillary Agreement that redefined the works schedule, restricting them to the ‘EXPO section’ only and increasing the overall amount of the investment to approximately €1.8 billion.

The works will last 88 months in total and are expected to finish in 2022.

In 2015, feasibility studies for design and scheduling variants were carried out, with the goal of optimizing existing construction sites, particularly in town centers, and aimed at mitigating their impact on the urban context.

The percentage of completion as of December 31, 2015 was 17.6%.

Another two variants were submitted in the first months of 2016:

- the “Centre Variant”, envisaging architectural and functional changes to City Centre Stations, as a result of the optimization of public pathways aimed at reducing the impact of construction sites on traffic and existing works.

- the “S. Cristoforo depot variant”, for the acknowledgment of CIPE (Inter-ministerial Committee for Economic Planning) provisions, the reclamation and depollution of the polluted site “Cava Roncheto”, as well as the implementation of amendments to national anti-seismic legislation.

The progression of all civil works of the EXPO Section, and the execution of civil works for the construction of stations along the entire section in areas that have already been handed over is envisaged for 2016.

Milan-Genoa High Speed/High Capacity Railway Line Project

This project involves the construction of the Milan to Genoa High Speed/High Capacity railway line, which was awarded by the CO.C.I.V. Consortium as the general contractor with a TAV (as operator of the State Railways)/CO.C.I.V. Agreement dated March 16, 1992.

Salini Impregilo is the consortium’s leader with a share of 68.25%.

The project suffered a complex and in-depth pre-contractual phase, which developed on a number of fronts from 1992 to 2011, many of which with controversy.

The contract for works on the Giovi Third Railway Crossing - Milan-Genoa High Speed/High Capacity Line, was signed in November 2011. The total value of the works awarded by CO.C.I.V. amounted to approximately €4.5 billion. The first and second lots of the project, already in progress, include construction works and activities for €1,131 million.

In 2015, a transactive agreement was signed, defining the allocation of design updates for a total amount of €511.7 million. The percentage of completion as of December 31, 2015 was 13.9%.

Verona-Padua High Speed/Capacity Railway Line Project

The IRICAV DUE Consortium is the General Contractor of Rete Ferroviaria Italia S.p.A. (RFI) for the design and development of the Verona-Padua section, on the basis of the Agreement of October 15, 1991, role confirmed by the arbitration award of May 23-26, 2012, res judicata. Salini Impregilo participates in the Consortium with a share of 34.09%, increased by 6.81% as a result of the increase in investment stakes from the Partner Lamaro Appalti S.p.A., which took place in 2015.

In October 2015, the Client received the final project drawings for the sub-section that is the subject of the contract, together with the bid. Moreover, the Final Project, inclusive of the relevant bid for the first functional lot, called “Verona - Vicenza junction”, was submitted and forwarded by the Client to the Ministry for Infrastrcture and Transport with notice of October 30, 2015, in order to proceed with the opening of the Conference of Services.

The approval process for the first functional lot shall continue during the first half-year of 2016 with the closure of the Conference of Services and the granting of the necessary authorizations by the Ministry of the Environment. The process is expected to come to end in the second half of 2016 with CIPE’s approval, the signing of an initial Addendum and the subsequent start of site preparation works.

Salerno-Reggio Calabria Highway Project: Lots 5 and 6

The project involves the improvement and modernization of the last section of the Salerno-Reggio Calabria A3 Highway in the section between the cities of Gioia Tauro and Scilla (Lot 5), and between Scilla and Campo Calabro (Lot 6). The Group is involved in the project with a 51% share.

Site progress is near completion, which is expected in 2016.

Concessions

With respect to the operating sector Italy, the portfolio of concession activities held by the Group consists of both equity investments in operators that have already fully entered the operational stage, and companies that are still developing projects and building the relevant infrastructure.

The concessions that are currently in the portfolio are mainly related to the transport sector (highways, subways, car parks).

The following tables show the key data for the operating sector Italy at December 31, 2015, broken down by activity type:

Highways

| Country | Concessionaire Company | % of investment | Total km | Stage | Start date | End date |

|---|---|---|---|---|---|---|

| Italy | SaBroM-Broni Mortara | 60.0 | 50.0 | not yet active | 2010 | 2057 |

| Italy (Ancona) | Dorico-Porto Ancona Bypass | 47.0 | 11.0 | not yet active | 2013 | 2049 |

Subway systems

| Country | Concessionaire Company | % of investment | Total km | Stage | Start date | End date |

|---|---|---|---|---|---|---|

| Italy (Milan) | Milan subway Line 4 | 9.7 | 15.0 | not yet active | 2014 | 2045 |

Car parks

| Country | Concessionaire Company | % of investment | Car parking spaces | Stage | Start date | End date |

|---|---|---|---|---|---|---|

| Italy (Terni) | Corso del Popolo S.p.A. | 55.0 | not yet active | |||

Other

| Country | Concessionaire Company | % of investment | Stage | Start date | End date | |

|---|---|---|---|---|---|---|

| Italy (Terni) | Piscine dello Stadio Srl | 70.0 | operational | 2014 | 2041 | |