The acquisition of 100% of Lane was finalised on 4 January 2016.

The IFRS provide that a subsidiary shall be consolidated starting from the date when control is acquired. Therefore, the condensed interim consolidated financial statements at 30 June 2016 present the statement of financial position figures at 31 December 2015 and the income statement figures as at and for the six months ended 30 June 2015 for comparative purposes that do not include Lane Group. It follows that the data for the first half of 2016 are not fully comparable.

In order to make these data more comparable with the corresponding period of 2015, this section sets out Salini Impregilo Group's key figures using the same consolidation scope.

The Group monitors the key figures of Lane Group for management purposes adjusting the IFRS figures to present the results of the non-subsidiary joint ventures consolidated on a proportionate basis. These management accounts results (works under management), show the progress made on the contracts managed directly by Lane Industries or through its non-controlling investments in the joint ventures.

The subsequent section on “Initial considerations on the comparability of data - Lane Industries Incorporated” provides more information on the following reconciliation of the adjusted key figures.

The paragraph “Alternative performance indicators” in the “Other information” section gives a definition of the financial statements indicators used to present the Group's highlights.

Consolidated income statement

| (in millions of Euros) | 1st half 2016 Adjusted | 1st half 2015 Adjusted |

|---|---|---|

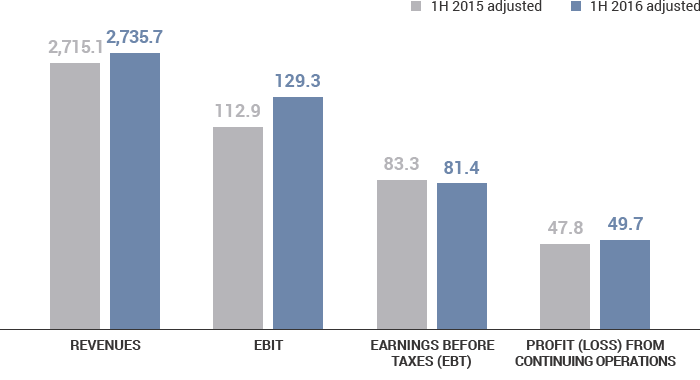

| Revenue | 2,735.7 | 2,715.1 |

| Gross operating profit | 252.8 | 221.3 |

| Gross operating profit margin (%) | 9.2% | 8.2% |

| Operating profit | 129.3 | 112.9 |

| R.o.S. | 4.7% | 4.2% |

| Net financing costs | (44.6) | (30.8) |

| Net gains (losses) on investments | (3.3) | 1.2 |

| Profit before tax | 81.4 | 83.3 |

| Income tax expense | (31.8) | (35.5) |

| Profit from continuing operations | 49.7 | 47.8 |

| Loss from discontinued operations | (20.4) | (5.1) |

| Non-controlling interests | (18.0) | (9.9) |

| Profit attributable to the owners of the parent | 11.2 | 32.9 |

Adjusted revenue for the period is €2,735.7 million compared to same-consolidation scope revenue of €2,715.1 million for the corresponding period of 2015. It includes revenue of the joint ventures not consolidated by Lane

of €96.2 million and €98.7 million, respectively. The increase in the caption refers to some large contracts such as the GERD dam in Ethiopia, the Red Line North Underground in Qatar, the Riyadh Metro Line 3 in Saudi Arabia, the Copenhagen Metro and Lane's ongoing projects.

The adjusted gross operating profit amounts to €252.8 million, up 14.2% on the corresponding period of 2015 while the adjusted operating profit of €129.3 million shows an improvement of about 14.5%.

The adjusted gross operating profit is equal to 9.2% of revenue and the adjusted R.o.S. is 4.7%.

Net financing costs approximately €44.6 million compared to €30.8 million for the corresponding period of 2015. The item comprises financial income of €21.9 million, net exchange rate gains of €2.1 million and financial expense of €68.6 million.

The profit before tax amounts to €81.4 million, which is substantially in line with the balance for the first six months of 2015 (€83.3 million). The tax rate is roughly 39% compared to 42%.

The loss from discontinued operations is €20.4 million and mainly refers to the release of the transaction reserve (€13.9 million) after the sale of Todini Costruzioni Generali in April 2016.

Non-controlling interests amount to €18.0 million and principally comprises €8 million for the Al Bayt Stadium and the Red Line North Underground in Qatar, €3 million for Lane's projects, €2 million for the motorway contract in Colombia and €5 million for other projects.