The “Alternative performance indicators” paragraph in the “Other information” section provides a definition of the indicators in the statement of financial position and income statement used to analyze the Group’s financial highlights.

The income statement data for the first half of 2014 were reclassified in accordance with IFRS 5. The restatement concerned the adoption of the IFRS 10 and 11 standards according to the procedures followed starting from the consolidated financial statement as at December 31, 2014.

Consolidated income statement

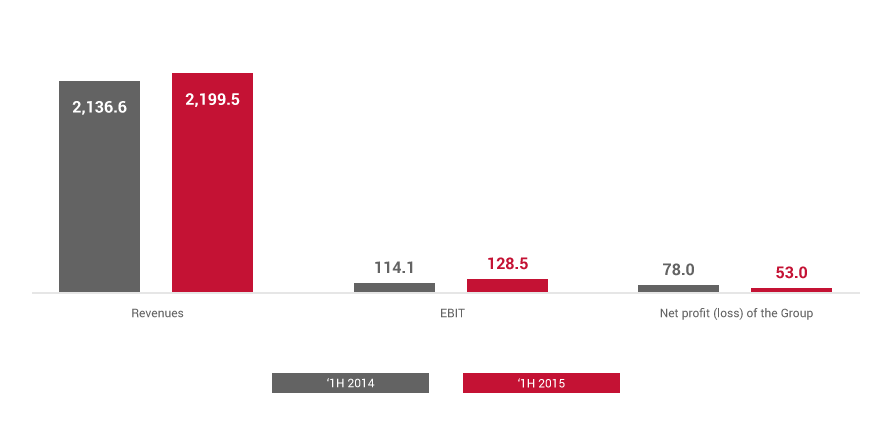

| (in millions of euro) | H1 2015 | H1 2014 (§) |

|---|---|---|

| Revenue | 2,199.5 | 2,136.6 |

| Operating costs (°) | (1,970.2) | (1,939.3) |

| Gross operating profit (EBITDA) | 229.3 | 197.4 |

| EBITDA % | 10.4% | 9.2% |

| Operating profit (EBIT) | 128.5 | 114.1 |

| R.o.S. | 5.8% | 5.3% |

| Financing income (costs) | (22.6) | (90.7) |

| Gains (losses) on investments | 1.2 | 1.7 |

| Earnings before taxes (EBT) | 107.2 | 25.2 |

| Income taxes | (35.3) | (9.6) |

| Profit (Loss) from continuing operations | 71.9 | 15.6 |

| Profit (loss) from discontinued operations | (11.6) | 60.9 |

| Profit (loss) for the period attributable to the owners of the parent | 53.0 | 78.0 |

(§) The income statement data for the first half of 2014 were reclassified in accordance with IFRS 5 according the new transfer perimeter of the Todini Costruzioni Generali Group. The reclassification concerned the adoption of the IFRS 10 and 11 standards according to the modalities followed in the consolidated financial statement as at December 31, 2014 and June 30, 2015.

(°) They include provisions and impairment losses for € 2.8 million.

Consolidated statement of financial position

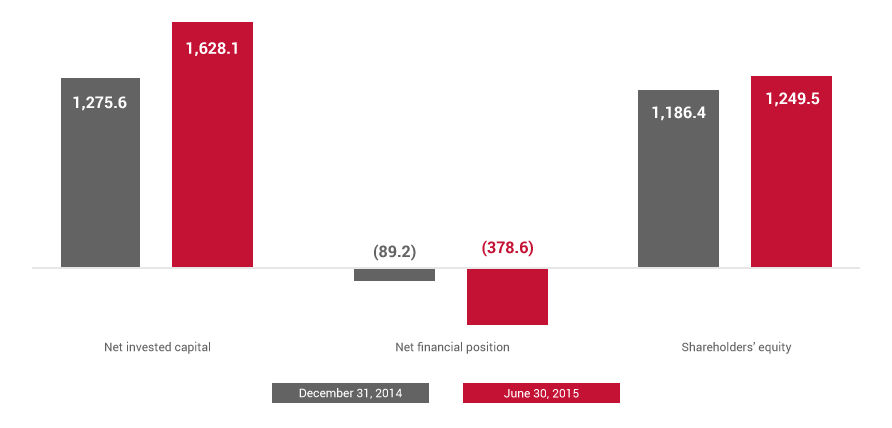

| (in millions of euro) | June 30, 2015 | December 31, 2014 |

|---|---|---|

| Non-current assets | 923.3 | 832.4 |

| Non-current assets (liabilities) held for sale | 67.3 | 84.1 |

| Provisions for risks, post-employment benefits and employee benefits | (131.7) | (120.8) |

| Net tax assets (liabilities) | 179.0 | 148.7 |

| Working capital | 590.3 | 331.3 |

| Net invested capital | 1,628.1 | 1,275.6 |

| Equity | 1,249.5 | 1,186.4 |

| Net financial position | 378.6 | 89.2 |