Introduction

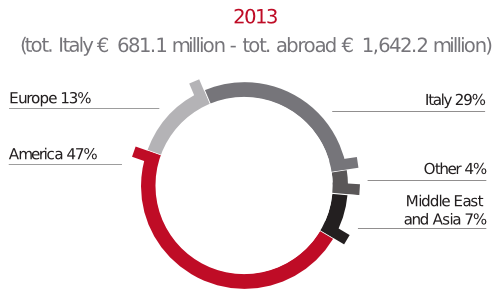

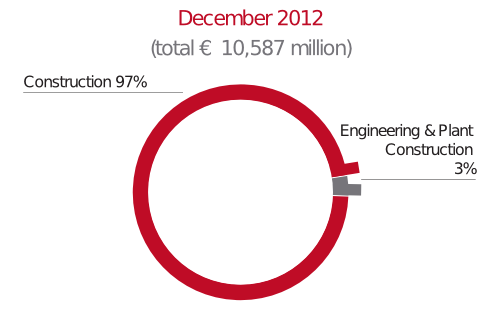

Impregilo Group closed 2013 with total revenue of € 2,323.3 million (2012: € 2,281.0 million), an operating profit of € 157.9 million (2012: operating loss of € 25.1 million) and a profit attributable to the owners of the parent of € 187.7 million (2012: € 603.1 million).

The parent, Impregilo S.p.A., recorded total revenue of € 1,276.4 million (2012: € 1,367.0 million), an operating profit of € 152.3 million (2012: € 111.5 million) and a profit for the year of € 113.8 million (2012: € 739.3 million).

The year 2013 was characterised by the substantial completion of the project known as 'National Champion' in which the shareholder Salini S.p.A., which at the beginning of the year had a shareholding of 29.9% of the share capital of Impregilo S.p.A., launched a voluntary takeover bid, pursuant to and for the purposes of articles 102 and 106, fourth paragraph, of Legislative Decree no. 58/1998, and designed to obtain all the ordinary shares of Impregilo. The Bid, whose full documentation was made available to the public under the terms and conditions required by current regulations, was launched on 18 March 2013 and was completed on 2 May 2013, at which date Salini S.p.A. held a shareholding of 92.08% of the ordinary shares making up the share capital of Impregilo. The shareholding in Impregilo was subsequently reduced and at the reference date of this Annual Report 2013 stood at 88.83%.

As an additional part of this plan, on 12 September 2013, the respective Extraordinary General Meetings of Salini S.p.A. and Impregilo S.p.A. approved the merger of Salini S.p.A. and Impregilo S.p.A.. The merger became fully effective from 1 January 2014, with an exchange ratio of 6.45 Impregilo ordinary shares for each Salini share, excluding cash adjustments, and from that date the merged company has assumed the name of Salini Impregilo S.p.A.. For the purposes of this Annual Report, to ensure the provision of consistent and uniform information, the previous company name will be retained for everything relating to management events prior to the effective date of the merger, in respect of which more complete information is contained in the disclosure documents made available to the public as required by the current legal and regulatory provisions.

An overview of the markets in which the Group is operating has in 2013 again shown somewhat diversified scenarios both in terms of the recovery of production levels in different geographical areas and from the political and social points of view. The international financial markets are still showing signs of uncertainty and do not yet support full deployment of the resources necessary for the development of large infrastructure projects, especially in the areas most affected by the recent financial crisis. In this context, however, the positioning of the Impregilo Group and the strategic synergies already implemented within the framework of commercial relations entered into with the Parent Company Salini S.p.A. have allowed important opportunities to be seized, both in markets where the two companies were already operating and in certain important new markets including Australia and Saudi Arabia.

Among the major events marking management of the financial year 2013 by Impregilo, particular importance has attached to further progress in the process of realising the non- core assets of the Group, including completion of sales to third parties of (i) the remaining share of 6.5% of the holding in the Brazilian group Ecorodovias, (ii) the entire interest held by the Group in the Chinese company Shanghai Pucheng Thermal Power Energy Co. Ltd. amounting to 50% of its capital stock and (iii) the holdings in the company Tangenziali Esterne di Milano S.p.A. (“TEM”) amounting to 3.74% of its capital and Tangenziale Esterna S.p.A. (“TE”) amounting to 17.77 % of its capital, including realisation of the stake held by Impregilo in infrastructure construction works through sale of the holding in Lambro S.c.a.r.l. within the Costruttori TEEM Consortium.

These operations produced € 11.4 million before tax.

As part of the complex events concerning the Campania Urban Solid Waste (USW) Projects, on the other hand, positive developments in the dispute over claims for damages made by the Group relating to former waste-derived fuel plants assumed particular importance during 2013, with the recovery of approximately € 240.8 million. Taking into account the impairment losses already made in respect of these claims in the financial years 2006 and 2007 (and only partly paid in 2012), a net profit of € 84.0 million was made and, in line with previous practice, this has been included in the results of discontinued operations. Another important feature of the Campania USW Projects was the absolute acquittal issued by the Court of Naples at the end of 2013 in relation to the criminal proceedings commenced in 2004. It should also be mentioned that, in this context, the Group had been the subject of significant in rem precautionary measures which in previous years had been quashed absolutely by the Court of Cassation. For more complete information regarding events related to the Campania urban solid waste projects, please refer to the next section of this Annual Report entitled 'Assets held for sale and discontinued operations'.

In terms of growth in industrial and commercial activities, major new orders were received in 2013 relating to works on the metro in Riyadh (Saudi Arabia), on the 'Red Line North' metro in Doha (Qatar) and the 'Skytrain' project in Australia in respect of which more complete information is provided, along with other new contracts received during the year, in the second part of the management information in this Annual Report.

Lastly, since the last half of 2013, events that have characterised the Group's operations to widen the Panama Canal, and which have already been covered specifically in previous Group financial documentation, have undergone significant developments, in particular an unexpected deterioration in contractual relations with the client. In this context, which is examined in greater detail in subsequent sections of this Annual Report, the group of international companies awarded the contract in which Impregilo is participating (which has in previous years already suffered major crises and increased costs due to causes largely attributable to the sphere of responsibility of the client) has found itself unable to continue construction activities. It was only recently possible to stabilise this development, which resulted from the repeated refusal of the client to collaborate in pursuing contractually agreed procedures governing the rights of the parties, by reaching an agreement under which it has been possible to resume construction activities. Inter alia, this agreement provided for resumption of the works and their completion by 31 December 2015 on the following basis: (i) joint financing by the client and the contractor of the remaining works, with particular reference to the extra costs incurred compared with the original estimates, and (ii) postponement of the refund of contractual advance payments, with a schedule compatible with the final allocation of all the extra costs between the parties on completion of the arbitration proceedings commenced at the same time. In this regard it should be noted that, from as early as 2012, the Impregilo Group, following a reasonably prudence-oriented approach and supported by the opinions of independent experts, had updated its own estimates relating to this order and recorded a significant final loss. On this assumption, following an evaluation approach which is consistently established and takes account of recent events, it was decided to update the evaluations previously carried out and consequently record additional net residual costs even though the overall amount is not particularly significant.

2013 total revenue is € 2,323.3 million compared with € 2,281.0 million for 2012.

The group’s consolidated operating profit is € 157.9 million (2012: operating loss of € 25.1 million), with a return on sales (R.o.S.) of 6.8% (2012: -1.1%). The Construction segment contributed profits of € 210.0 million (R.o.S. of 9.7%) and Plant € 0.3 million (R.o.S. of 0.2%) (2012: € 21.0 million). The Concessions segment made an operating loss of € 6.0 million.

The group’s other segments made an operating loss of € 1.8 million (€ 1.8 million), while the corporate structure’s net costs came to € 44.7 million (€ 44.7 million).

Financing income (costs) and gains (losses) on investments came to a positive € 3.3 million compared with a negative € 29.3 million for 2012.

The profit from discontinued operations amounts to € 80.6 million (profit of € 717.0 million for 2012) and mainly reflects the results of the Campania urban solid waste projects, regarding which more complete information is provided elsewhere in this Annual Report.

The profit attributable to the owners of the parent for the year is € 187.7 million (€ 603.1 million for 2012). Both of the foregoing figures benefit from the effects of the discontinued operations described above.

The net financial position at 31 December 2013 is € 421.5 million compared with € 613.4 million at 31 December 2012. The net debt/equity ratio is therefore a negative value of -0.30.

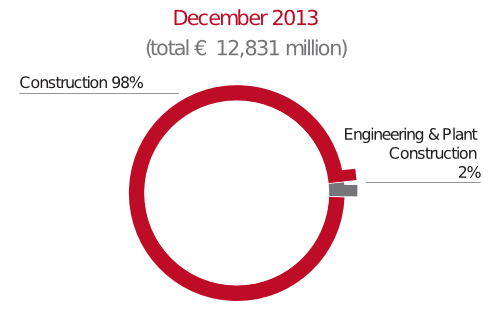

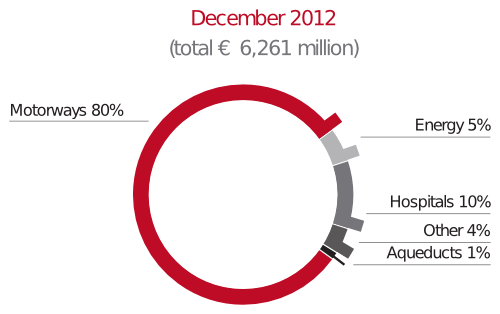

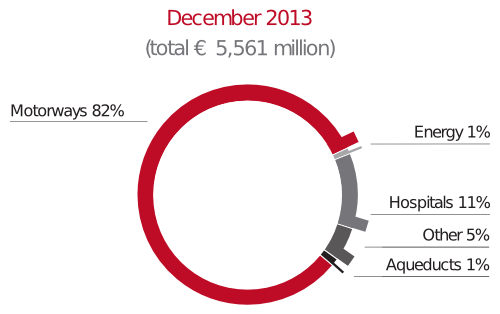

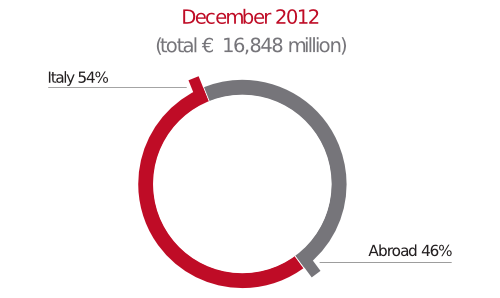

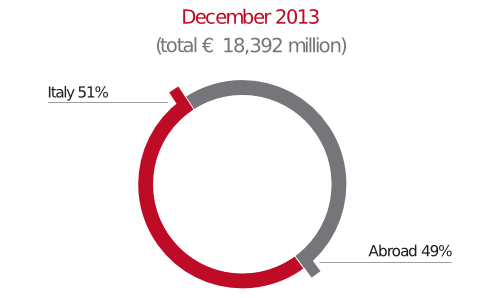

At year end, the group’s order backlog amounted to € 18.4 billion, including € 12.8 billion in the Construction & Plant segments and € 5.6 billion related to the residual backlog in the Concessions segment.

The group acquired new contracts worth € 6,374.0 million during the year.

The parent’s 2013 total revenue is € 1,276.4 million compared with € 1,367.0 million for 2012).

The operating profit of Impregilo S.p.A. is €152.3 million (€ 111.5 million for 2012) with a R.o.S. of 11.9% (8.2% in 2012).

The parent’s financing income (costs) and gains (losses) on investments for 2013 come to a positive € 11.7 million compared with a positive € 671.4 million for 2012).

Finally, the separate financial statements of Impregilo S.p.A., show a profit for 2013 of € 113.8 million compared with a profit of € 739.3 million for 2012) and a net financial position at 31 December 2013 of € 128.7 million (€ 666.7 million at 31 December 2012).

The paragraph “Alternative performance indicators” in the “Other information” section gives a definition of the financial statements indicators used to present the group’s highlights.

The income statement for 2012 has been resubmitted to reflect the effects of IAS 19 revised in 2011 and applied retrospectively by the Impregilo Group as from 2013.

To align with the informational approach followed by the parent, activities relating to subordinated loans granted to affiliated companies and receivables from the sale of investments - previously shown in Net Invested Capital - have been reclassified in the Net Financial Position.

Consolidated income statement

| (Values in millions of Euros) | 2013 | 2012 (*) |

|---|---|---|

| Revenue | 2,323.3 | 2,281.0 |

| Costs | (2,072.4) | (2,196.3) |

| Gross operating profit | 250.9 | 84.7 |

| Gross operating profit % | 10.8% | 3.70% |

| Operating profit (loss) | 157.9 | (25.1) |

| R.o.S. | 6.8% | -1.1% |

| Net financing income (costs) | 0.7 | (30.7) |

| Net gains (losses) on investments | 2.5 | 1.4 |

| Profit (loss) before tax | 161.2 | (54.4) |

| Income tax expense | (53.7) | (59.3) |

| Profit from continuing operations | 107.4 | (113.6) |

| Profit from discontinued operations | 80.6 | 717 |

| Profit attributable to the owners of the parent | 187.7 | 603.1 |

(*) Figures restated following the application of IAS 19 revised

Consolidated statement of financial position

| (Values in millions of Euros) | 31 December 2013 | 31 December 2012 (*) |

|---|---|---|

| Non-current assets | 345.2 | 408.2 |

| Goodwill | 11.9 | 30.4 |

| Non-current assets held for sale, net | 5.7 | 307.6 |

| Provisions for risks, post-employment benefits and employee benefits | (112.4) | (118.5) |

| Other non-current assets, net | 10.7 | 11.6 |

| Net tax liabilities | 139.2 | 137.6 |

| Working capital | 577.2 | 415.5 |

| Net invested capital | 977.5 | 1,192.4 |

| equity | 1,399.0 | 1,805.8 |

| net financial position | 421.5 | 613.4 |

| Debt/Equity ratio |

-0.30 | -0.34 |

(*) To align with the informational approach followed by the parent, activities relating to subordinated loans granted to affiliated companies and receivables from the sale of investments - previously shown in "Other non-current assets, net" and "Working capital" - have been reclassified in the Net Financial Position.

Separate income statement

| (Values in millions of Euros) | 2013 | 2012 (*) |

|---|---|---|

| Revenue | 1,276.4 | 1,367.0 |

| Costs | (1,106.9) | (1,223.7) |

| Gross operating profit | 169.5 | 143.3 |

| Gross operating profit % | 13.3% | 10.5% |

| Operating profit | 152.3 | 111.5 |

| R.o.S. | 11.9% | 8.2% |

| Net financing income (costs) | 25 | 1.5 |

| Net gains (losses) before tax | (13.2) | 669.9 |

| Profit (loss) before tax | 164.1 | 782.9 |

| Income tax expense | (50.2) | (43.6) |

| Profit from continuing operations | 113.8 | 739.3 |

| Profit for the year | 113.8 | 739.3 |

(*) Figures restated following the application of IAS 19 revised

Separate statement of financial position

| (Values in millions of Euros) | 31 December 2013 | 31 December 2012 |

|---|---|---|

| Non-current assets | 642.2 | 646.1 |

| Provisions for risks, post-employment benefits and employee benefits | (218.5) | (264.9) |

| Other non-current assets, net | 2.1 | 89.0 |

| Net tax liabilities | (17.9) | (30.2) |

| Working capital | 657.2 | 575.6 |

| net invested capital | 1,065.2 | 1,015.6 |

| equity | 1,193.8 | 1,682.3 |

| net financial position | 128.7 | 666.7 |

| Debt/Equity ratio |

-0.11 | -0.4 |

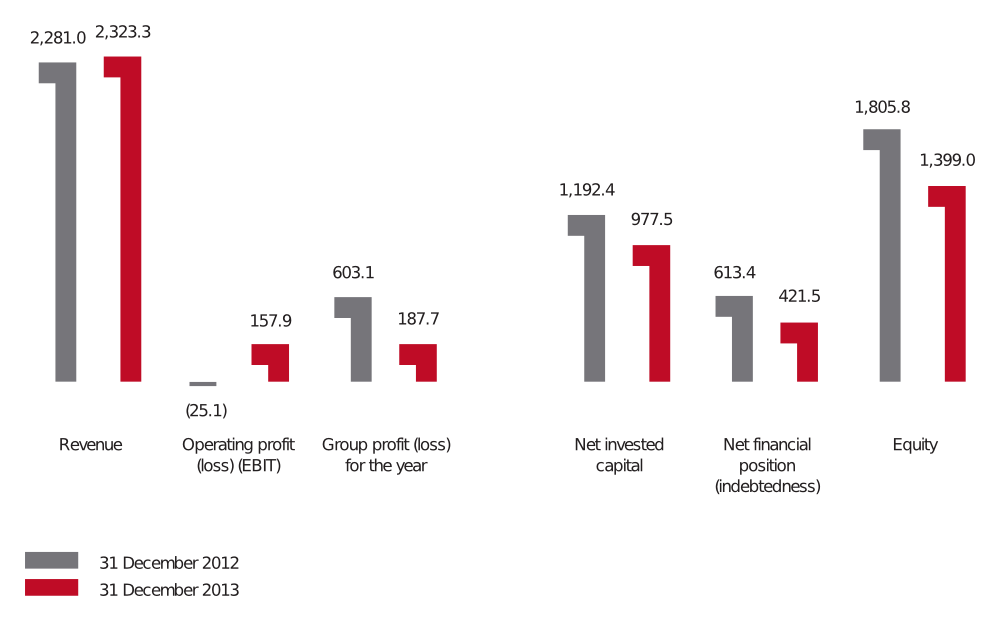

Order backlog - Construction, Plant

Order backlog - Concessions

Order backlog by geographical segment - Construction, Plant and Concessions

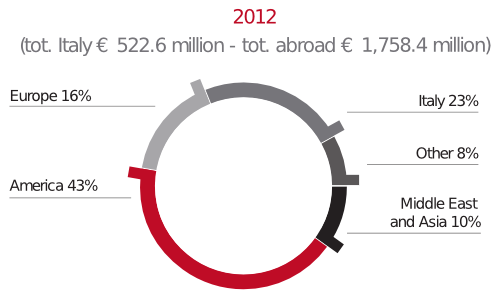

Revenue by geographical segment