Financial report

Sustainability report

After the completion of the merger between Salini and Impregilo in January 2014, we demonstrated our ability to integrate businesses, to create value for our shareholders and to achieve our business plan target, profit and enhancement of human resources.

Pietro Salini, CEO

Salini Impregilo

Highlights

€ 3,4 bln

+8.4% vs. 9M 2014

€ 340.4 mln

+11.1% vs. 9M 2014

€ 185.2 mln

+2.6% vs. 9M 2014

€ 80.2 mln

(27.5%) vs. 9M 2014

€ 87.8 mln

+94.0% vs. 9M 2014

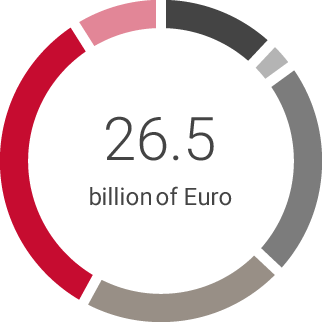

September 2015 - Construction backlog and revenues by geographic area

Construction backlog

italy 33%

Europe 9%

Americas 12%

Africa 22%

Asia & Australia 3%

Middle East 21%

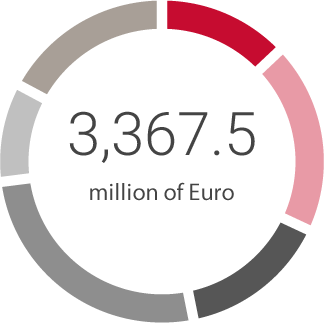

9M 2015 Revenues

Italy 13%

Europe 19%

Americas 15%

Africa 26%

Asia & Australia 10%

Middle East 17%

Total Backlog Increase

Dec 2014

Sep 2015

Billion of Euro

Financial data

Reclassified income statement of the Salini Impregilo Group

| Thousand € | Jan-Sep 2015 | Jan-Sep 2014 (*) | change |

|---|---|---|---|

| Operating revenue | 3,285,006 | 3,043,977 | 241,029 |

| Other revenue | 82,485 | 62,623 | 19,862 |

| Total revenue | 3,367,491 | 3,106,600 | 260,891 |

| Costs (**) | (3,027,132) | (2,800,291) | (226,841) |

| Gross operating profit | 340,359 | 306,309 | 34,050 |

| Gross operating profit % | 10.1% | 9.9% | |

| Amortisation and deprecation | (155,203) | (125,863) | (29,340) |

| Operating profit (loss) | 185,156 | 180,446 | 4,710 |

| Return on Sales % | 5.5% | 5.8% | |

| Net financing costs | (59,275) | (114,749) | 55,474 |

| Net gains on investments | (392) | 5,790 | (6,182) |

| Net financing costs and net gains on investments | (59,667) | (108,959) | 49,292 |

| Profit (loss) before tax | 125,489 | 71,487 | 54,002 |

| Income tax expense | (37,647) | (26,201) | (11,446) |

| Profit (loss) from continuing operations | 87,842 | 45,286 | 42,556 |

| Profit from discontinued operations | (7,655) | 65,265 | (72,920) |

| Profit (loss) for the period | 80,187 | 110,551 | (30,364) |

| Non-controlling interests | (11,407) | (2,276) | (9,131) |

| Profit (loss) for the period attributable to the owners of the parent | 68,780 | 108,275 | (39,495) |

(*) The income statement data for the first 9 months of 2014 were reclassified in accordance with IFRS 5 according the new transfer perimeter of the Todini Costruzioni Generali Group. The restatement concerned the adoption of IFRS 10 and 11 standards according to the modalities followed in the consolidated financial statements as at December 31, 2014.

(**) They include provisions and impairment losses for € 5,875 thousands

Reclassified consolidated balance sheet of the Salini Impregilo Group

| Thousand € | September 30, 2015 | December 31, 2014 | change |

|---|---|---|---|

| Non-current assets | 897,621 | 832,355 | 65,266 |

| Non-current assets held for sale, net | 68,740 | 84,123 | (15,383) |

| Provisions for risks | (106,515) | (97,527) | (8,988) |

| Post-employment benefits and employee benefits | (22,776) | (23,320) | 544 |

| Net tax assets | 180,584 | 148,698 | 31,886 |

| Inventories | 276,817 | 262,740 | 14,077 |

| Contract work in progress | 1,698,957 | 1,252,769 | 446,188 |

| Progress payments and advances on contract work in progress | (1,761,048) | (1,725,884) | (35,164) |

| Receivables (*) | 1,645,556 | 1,614,350 | 31,206 |

| Payables | (1,521,495) | (1,426,743) | (94,752) |

| Other current assets | 570,351 | 689,997 | (119,646) |

| Other current liabilities | (326,942) | (335,918) | 8,976 |

| Working capital | 582,196 | 331,311 | 250,885 |

| Net invested capital | 1,599,850 | 1,275,640 | 324,210 |

| Equity attributable to the owners of the parent | 1,147,041 | 1,109,903 | 37,138 |

| Non-controlling interests | 95,479 | 76,513 | 18,966 |

| Equity | 1,242,520 | 1,186,416 | 56,104 |

| Net financial position | 357,330 | 89,224 | 268,106 |

| Total financial resources | 1,599,850 | 1,275,640 | 324,210 |

(*) The Receivables items is considered net of € 35.0 million (€65.9 millionas at December 31,2014) classified in the net financial position, referred to the net receivables/payables financial position of the Group towards Consortiums and Consortium Companies (SPV) that function through cost transfers and the are not included within in the Group's consolidation scope. The net receivables/payables position is included in the net financial position based on the actual liquidity or indebtness owned by the SPV.

Net financial position of the Salini Impregilo Group

| Thousand € | September 30, 2015 | December 31, 2014 | change |

|---|---|---|---|

| Non-current financial assets | 100,015 | 89,124 | 10,891 |

| Current financial assets | 220,379 | 156,908 | 63,471 |

| Cash and cash equivalents (*) | 995,221 | 1,030,925 | (35,704) |

| Total cah and cash equivalents and other financial assets | 1,315,615 | 1,276,957 | 38,658 |

| Bank and other loans | (520,569) | (456,209) | (64,360) |

| Bonds | (395,842) | (394,326) | (1,516) |

| Finance lease payables | (98,100) | (102,310) | 4,210 |

| Total non current indebteness | (1,014,511) | (952,845) | (61,666) |

| Current portion of bank loans and current accounts facilities | (479,254) | (247,522) | (231,732) |

| Current portion of bonds | (163,794) | (166,292) | 2,498 |

| Current portion of finance lease payables | (45,950) | (60,231) | 14,281 |

| Total current indebteness | (688,998) | (474,045) | (214,953) |

| Derivative assets | 5 | 0 | 5 |

| Derivative liabilities | (4,486) | (5,244) | 758 |

| Financial assets held by SPVs and unconsolidated project companies (**) | 35,045 | 65,953 | (30,908) |

| Total other financial assets (liabilities) | 30,564 | 60,709 | (30,145) |

| Total net financial position-continuing operations | (357,330) | (89,224) | (268,106) |

| Net financial position for assets held for sale | (71,090) | (81,292) | 10,202 |

| Net financial position including non-current assets held for sale | (428,420) | (170,516) | (257,904) |

(*) It includes the amount of € 77.3 million of tied-up liquidity of the Cavtomi Consortium, due to a litigation.

(**) This item acknowledges the net credit/debit position of the Group towards Consortiums and Consortium Companies ("SPVs") functioning through cost transfers and not included in the consolidation scope of the Group. The net credit standing and debt position is included in the item in the amount corresponding to the actual liquidity or indebtedness owned by the SPV. The receivables and payables that compose the balance of the item are respectively included among the commercial credit and commercial debts.

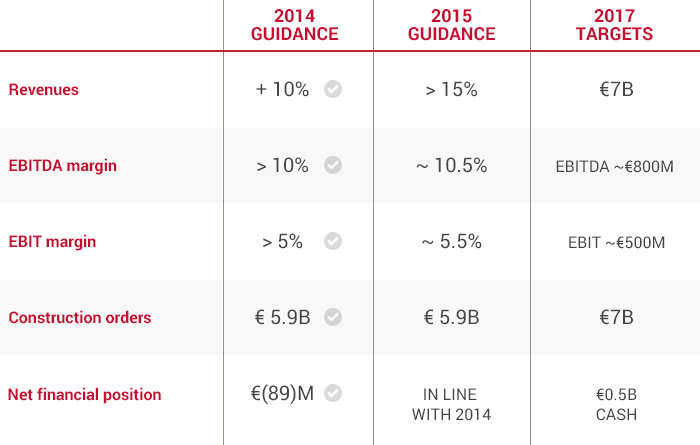

2015 Guidance & Business Plan Targets