The Group operates in the construction and concessions sectors in Italy.

Macroeconomic scenario

Italy’s development prospects have become more positive and the country has resumed growth. The OECD ranked Italy as one of the Eurozone economies with the highest growth rates of the year, thanks to the improved labour market conditions and the related upturn in domestic consumption. The 2015 budget deficit decreased to 2.6% of GDP and is expected to continue this trend, mainly as a result of the economy’s cyclical recovery and the lower interest rates.

GDP is forecast to grow by 1% in 2016 and 1.4% in 2017, driven mainly by household consumption. The rise in employment has temporarily slowed down while domestic spending is boosted by the increase in consumption. Investments have picked up, thus also assisting internal demand despite the lending constraints put in place by banks hindering a faster recovery.

The government has reiterated its commitment to gradual tax consolidation and a structural reform programme. In order to create the fiscal space needed to increase public investments and avoid increasing indirect taxes, as planned for 2017, the government intends to resort to the budget flexibility clause provided for by the EU while concurrently containing public spending.

The collapse in investments caused by the economic crisis, which triggered a long-term deceleration of the economy, was followed by an upturn in the production of investment goods. Together with the low recorded by the construction sector, this could herald a possible reversal in the investments cycle, although the scarce bank funding available and uncertainty about future demand continue to hold back this positive trend.

The outlook for growth is improving and Italy has continued its exit from the second recession which started in the summer of 2011 and continued until autumn 2014, just after the shorter but more intense crisis of 2008/2009. The speed of its recovery is strongly influenced by the international economic climate. The structural reform programme’s positive status is assisting consolidation of long-term forecasts even though there is much ground to cover to improve the country’s productivity and efficiency. Any delays in implementing its ambitious public investment programme will slow down its recovery. In addition, Brexit and renewed volatility in the Eurozone’s financial markets may propagate risks and increase the cost of borrowing, which would increase the tax burden.

Construction

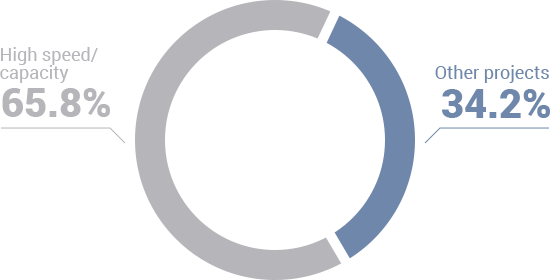

The order backlog for the Italian construction segment is as follows:

| Area | Residual backlog at 30 June 2016 | Percentage of total |

|---|---|---|

| High speed/capacity | 5,857.4 | 65.8% |

| Other projects | 3,049.8 | 34.2% |

| Total | 8,907.2 | 100.0% |

The following chart provides a breakdown of the order backlog by type of business:

Breakdown of the Italian construction order backlog

| (Share in millions of Euros) | Residual backlog | Percentage of completion |

|---|---|---|

| Project | ||

| Cociv Lot 1-6 | 3,743.9 | 17.4% |

| Iricav 2 | 2,110.2 | - |

| Other | 3.3 | |

| High speed/capacity | 5,857.4 | |

| Broni - Mortara | 981.5 | - |

| Metro B | 946.3 | 0.1% |

| Milan Metro Line 4 | 402.8 | 21.2% |

| Jonica state highway 106 | 336.2 | 2.6% |

| Other | 383.0 | |

| Other work in Italy | 3,049.8 | |

| Total | 8,907.2 |

High speed/capacity Milan-Railway Project

The project for the construction of this railway line was assigned to the COCIV Consortium as general contractor by RFI S.p.A. (Rete Ferroviaria Italia, formerly TAV S.p.A. - as Ferrovie dello Stato’s operator) with the agreement of 16 March 1992. The project’s pre-contractual stage was complicated and difficult, with developments from 1992 to 2011 on various fronts, including many disputes (more information is available in the paragraph on disputes in the section on the “Main risk factors and uncertainties”).

On 11 November 2011, a rider to the agreement was signed for the assignment to the consortium of the design and construction of the Giovi third railway crossing of the high speed/capacity Milan - Genoa railway line.

The works began on 2 April 2012 and the contract is worth approximately €4,500 million.

It is split into six non-functional construction lots for a total of roughly 120 months including the pre-operating/inspection phase.

Salini Impregilo is the consortium leader with a percentage of 68.25%.

During the period, RFI activated the third construction lot 21 months behind schedule, increasing the total value of the works and activities financed and under construction to €1,634 million, €537 million higher than the active lots (1 and 2).

High speed/capacity Verona-Padua Railway Project

The IRICAV DUE Consortium is RFI’s general contractor for the design and construction of the high speed/capacity Verona-Padua section as per the agreement of 15 October 1991. Its role was confirmed by the arbitration award of 23-26 May 2012, which has become definitive. Salini Impregilo’s current involvement in the consortium is 34.09%. During the period and together with its partner Astaldi, Salini Impregilo communicated its interest in acquiring the stakes of Ansaldo STS of 8.12% and 8.93%, respectively. Should this acquisition go ahead (it has firstly to be approved by RFI in the next few months), Salini Impregilo’s share of the consortium fund would increase to 42.21%.

In 2015, the consortium provided the customer with the definitive project drawings for the Verona-Vicenza sub-section with the bid. It also delivered the definitive project, inclusive of the related bid, for the first functional lot, the Verona-Vicenza junction.

On 23 March 2016, the Services Conference took place in the presence of the Directorate General for Railway Transport and Railway Infrastructure of the Ministry of Infrastructure and Transport (MIT), attended by the bodies involved in the project.

The approval process for the first functional lot will continue in the second half of 2016 and the related rider should be signed by the end of the year, allowing the consortium to start up site activities in early 2017.

The contract is worth an estimated €5 billion, of which €2.1 billion for the first functional lot, the Verona-Vicenza junction.

Concessions

The Group’s portfolio of concession activities in Italy mainly consists of investments in the operators still involved in developing projects and constructing the related infrastructure.

These concessions principally relate to the transport sector (motorways, metros and car parks).

The following tables show the key figures of the Italian concessions at the reporting date, broken down by business segment.

MOTORWAYS

| Country | Operator | % of investiments | total km | Stage | Start date | End date |

|---|---|---|---|---|---|---|

| Italy | SaBroM-Broni Mortara | 60.0 | 50 | Not yet active | 2010 | 2057 |

| Italy (Ancona) | Dorico-Porto Ancona bypass | 47.0 | 11 | Not yet active | 2013 | 2049 |

METROS

| Country | Operator | % of investiment | total km | Stage | Start date | End date |

|---|---|---|---|---|---|---|

| Italy (Milan) | Milan Metro Line 4 | 9.7 | 15 | Not yet active | 2014 | 2045 |

CAR PARKS

| Country | Operator | % of investiment | No.of parks | Stage | Start date | End date |

|---|---|---|---|---|---|---|

| Italy (Terni) | Corso del Popolo S.p.A. | 55.0 | Not yet active | 2016 | 2046 |

OTHER

| Country | Operator | % of investiments | Stage | Start date | End date |

|---|---|---|---|---|---|

| Italy (Terni) | Piscine dello Stadio S.r.l. | 70.0 | Active | 2014 | 2041 |