The Group is active in the construction and concessions sectors abroad.

Macroeconomic scenario

The global economy continued to recover during the period albeit at a slower and weaker pace than expected. Markets were still volatile and the advanced economies saw a slowdown in their growth early in the year. The performance of the low income countries varied while the entire geopolitical situation continues to be uncertain.

Despite this discouraging economic context, the general climate benefitted from positive factors such as better-than-expected economic figures, the partial stabilisation of oil prices, the smaller outflow of capital from China and the central banks’ expansionary policies. The IMF has forecast global growth of 3.2% in 2016 and 3.5% in 2017, which are slightly below the actual figures for January 2016 (by 0.2% and 0.1%, respectively). The advanced countries’ growth should be in the region of a modest 2%. A stable growth rate of 2.4% is expected for the US, with a slight improvement in 2017. The contraction in investments, high unemployment rates and weaker financial situations of businesses all heavily impacted development in the Eurozone, whose growth rate is forecast to be a moderate 1.5% for 2016 while it is expected to increase to 1.6% in 2017.

The emerging markets and developing countries will continue to make up the largest share of global growth in 2016, even through their growth patterns will be discontinuous and slower than those seen in the last 20 years.

The challenges facing the world will be similar to those seen in 2015, that is, falling raw materials prices, an increasingly strong dollar and a decelerating Chinese economy.

Another source of concern is the Brexit referendum held in Great Britain on 23 June. Its exit from the European market may cause upheaval and a reduction in trade and cash flows, limiting the benefits of economic cooperation and integration. The rating agency Standard & Poor’s has estimated that the Brexit effect may lead to an 0.8% reduction in the Eurozone’s GDP between 2017 and 2018.

Construction

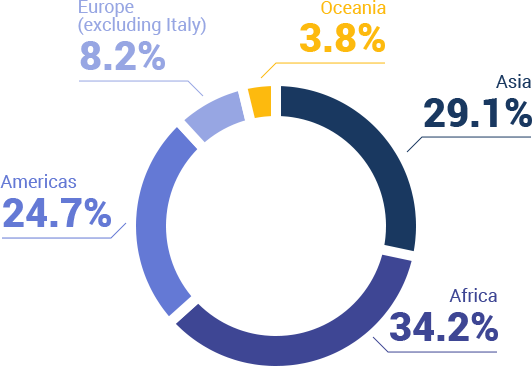

The order backlog for the foreign construction segment is as follows:

| Country | Residual backlog at 30 June 2016 | Percentage of total |

|---|---|---|

| Asia | 6,498.7 | 29.1% |

| Africa | 7,634.4 | 34.2% |

| Americas | 5,524.3 | 24.7% |

| Europe (excluding Italy) | 1,842.6 | 8.2% |

| Oceania | 839.2 | 3.8% |

| Total | 22,339.2 | 100.0% |

The following chart provides a breakdown of the order backlog by type of business:

Breakdown of the foreign construction order backlog