The Group operates internationally in the Construction and Concession sectors.

Macroeconomic scenario

In 2015, the world economy grew at a slower pace. Initial estimates of the International Monetary Fund indicate a value of 3.1%, versus a GNP growth of 3.4 % in the previous year.

Developed economies as a whole grew by 1.9% in 2015: +0.1% compared to the previous year. The United States were one of the most resilient economics, growing by 2.5% compared to 2.4% in 2014. The improvement of the economy, the growth in job creation and the increase in domestic consumption led the Federal Reserve to adopt a less flexible monetary policy for the first time in almost a decade. This maneuver contrasted the more accommodating measures implemented by Japanese and European monetary authorities, strengthening the US dollar over the euro as a result.

Developing and emerging countries experienced a number of issues, since management of their debt, denominated in dollars, became more onerous. The currencies of these countries, moreover, suffered from the drastic fall in the price of raw materials and oil in particular. Emerging and developing economies, which accounted for over 70% of global growth in 2015, grew by 4.0% as a whole, a lower percentage compared to last year (4.6%), a level that, according to the IMF, will not be reached again before 2017.

The Eurozone recorded a growth of 1.5%, higher than the 0.9% posted in 2014, despite many issues and challenges faced along the way, including the wave of migration of asylum seekers, fighting unprecedented misery and violence in some African and Middle Eastern countries.

For 2016, the World Bank forecasts a certain stability for raw material prices, but various risk factors could change this scenario. If the slowdown of the Chinese and other economies were to be quicker than expected, the growth trend at global level would be inevitably influenced. The IMF forecasts a global GNP growth rate of 3.4% for 2016 and 3.6% for 2017. The challenges that the world will have to face this year are almost the same as last year’s: low raw material prices, an even stronger dollar and the slowdown of the Chinese economy.

Construction

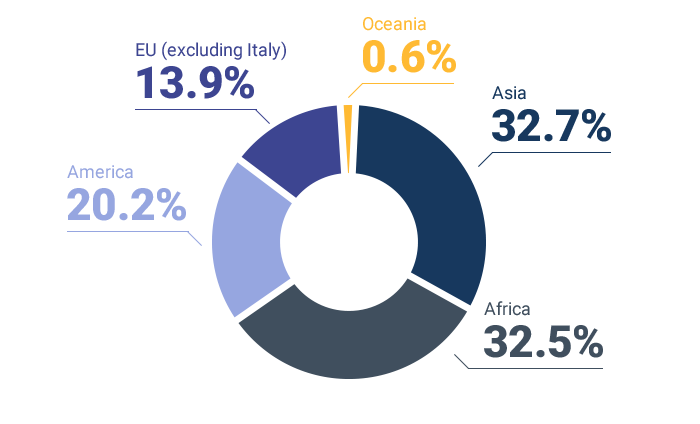

The order portfolio for the International construction sector is shown below:

| Country | 2015 residual portfolio | Percentage of total |

|---|---|---|

| Asia | 5,608.3 | 32.7% |

| Africa | 5,578.0 | 32.5% |

| America | 3,459.1 | 20.2% |

| Europe (excluding Italy) | 2,391.2 | 13.9% |

| Oceania | 104.8 | 0.6% |

| Total | 17,141.4 | 100.0% |

The following chart shows the breakdown of the portfolio by type of activity:

Summary of International Construction Order Portfolio